On Nov. 9, 2023, the IRS released Revenue Procedure 2023-34 (Rev. Proc. 23-34), which includes the inflation-adjusted limit for 2024 on employee

The Internal Revenue Service (IRS) has issued Notice 2023-70 to increase the Patient-Centered Outcomes Research Institute (PCORI) fee amount for plan

On May 16, 2023, the IRS released Revenue Procedure 2023-23 to provide the inflation-adjusted limits for health savings accounts (HSA) and high

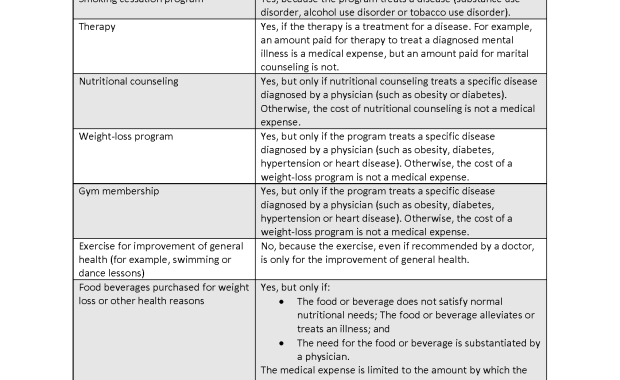

On March 17, 2023, the IRS released a set of frequently asked questions (FAQs) to address whether certain costs related to general health, nutrition

The Consolidated Omnibus Budget Reconciliation Act (COBRA) is a federal law that requires most employers to provide former employees and dependents

The Biden Administration has announced its plan to end the COVID-19 national emergency and public health emergency (PHE) on May 11, 2023.

On Jan. 30, 2023, the Biden administration released a statement announcing that it plans to end the COVID-19 public health emergency (PHE) and

On Oct. 18, 2022, the IRS released Revenue Procedure 2022-38 (Rev. Proc. 22-38), which includes the inflation-adjusted limit for 2023 on employee

In 2020, the federal government finalized benefits compliance requirements for health insurance carriers and employer-sponsored health plans to

As a business owner or HR director, open enrollment can be stressful. With the plethora of acronyms used in the health insurance industry, it’s easy